-

In 1894 the Southern took over the Richmond and Danville Railroad, bought the Western North Carolina Railroad, outright, and popularized the latter's western terminus, Asheville, as an elite vacation resort in the "Land of the Sky".

The Biltmore House, as it is known today by tourists, is the only hotel, not private home as it is purported to

have been, in the area which could remotely be considered "elite". Included in this chapter is an example of the hotel and estate, which is today claimed by the Vanderbilt family to be their official family residence. They never bought it from the railroad, the railroad can never sell any of its assets, and the Vanderbilt family has managed to go bankrupt at least twice since the Civil War and the 1900's. Therefore how can it be possible that they own t h i s hotel, or private home as they claim?

George Vanderbilt was chosen by the Payseur family to become the in-resident manager and supervisor of the huge hotel and grounds. The hotel was placed on a 99 year lease, with the Vanderbilt family to be the trustees. The Vanderbilt's were the trustees of this hotel to care for and operate it for the duration of the lease, which is soon to end as of June 17. 1993. As of now, since they were asked if they, being the Vanderbilt heirs, would like to renew their lease on the hotel or would they like to vacate, no answer has been received.

315

The lease is recorded in a court house not too far away from that area, on the railway line that passed though the odd section of land, number 27. which the Biltmore Motel is setting on. Norfolk Southern Railway passes right through the northern corner of section 27.

George Vanderbilt was born of Dutch decent. The Biltmore Hotel and a great deal of the furnishings in the Hotel are French, the same as the Payseur family. The family called the hotel their country palace and named it Swanannoa. A river by the same name flows through that property.

While on a tour in the Biltmore Hotel, the guide in my group was asked the question "where did the young George Vanderbilt of only about twenty three years of age get the money to built such a home?" The answer that was given was that they really couldn't find out where he got the money because the entire family had gone bankrupt in the time of the 1893 panic. They had also lost everything at the end of the Civil War and had just become trustees. I had the answer to the ladies question but had to bite my tongue to keep my mouth shut.

Biltmore is enormous-it has about 255 rooms. The Banquet Hall, the largest room in the house, is 72 feet long.

42 feet wide, and 75 feet high.

The work was planned and carried out like a military operation. A private railway spur nearly three miles long and costing $77,500 was constructed to carry building materials from the main railroad line to the house site. The principal material was limestone, brought 600 miles from Indiana. Hundreds of workmen labored on the house. Labor was very cheap: wages were from fifty cents to a dollar a day; and a mule could be hired for about the same price!

A little town called Biltmore Village was built at the front gates to accommodate some of the workers. In addition to houses for the staff, it held offices, a railroad station, shops, sawmills, and a brick factory capable of turning out 32,000 bricks a day.

Biltmore House, although a pretty faithful reconstruction of an early French Renaissance chateau, in particular the Chateau de Blois, was up-to-date with internal conveniences. It had central heating, plumbing, refrigeration, elevator and dumbwaiter equipment, and it was lighted by electricity. Even with all modern conveniences, the house and the stables, which had stalls for forty horses, required a staff of eighty servants. Several hundred more worked on the grounds.

The interiors of the house were a combination of antique and reproduction furniture, some of it made especially for the house. Richard Morris Hunt the architect of the structure, also designed the table in the Banquet Hall and a pair of throne chairs, which were carved by the sculptor. Karl Bitter. Other furniture and decorations were in various "revival" styles, Gothic, Renaissance, Baroque, Louis XV, Sheraton, etc.. Scattered throughout the rooms were nineteenth century paintings and sculpture; many were Oriental objects of art.

In the mid-1880's, the new resort for the south was established in the Asheville, North Carolina area. The region was remote-it did not have passenger railway service until 1880. The site for this fabulous resort had beautiful forested regions. Using agents, so that the price would not go up on the rumor that the railroad was buying up land, agents obtained even sections of land that were already settled by farmers. The odd square mile sections were already owned by the railroad. By 1888, they had acquired about 2,000 acres for the tentative beginnings for the resort hotel of the south. In 1895 the entire Pisgah forest was bought, comprising about 80.000 acres of about half was already owned by the Payseur family. By the turn of the century, he owned some 100.000 acres for the resort in the North Carolina mountains.

The resort area had an extraordinary range of species of trees, the forest was in a deplorable state, "burned, slashed, and overgrazed," in the words of Gifford Pinchot. the chief forester for the resort.

In December 1891, young Gifford Pinchot took charge of Biltmore Forest at an annual salary of $2,500 and subsistence. He was anxious to put into practice the theory of forestry that he had learned in Europe. He wanted "to prove that trees could be cut and the forest preserved at one and the same time. "He made the Biltmore the first piece of woodland in the United States to be put under a regular system of forest management whose object was to pay the owner while improving the forest.

316

Pinchol entered into h i s task with great enthusiasm, at ease with his employer. The first public knowledge of the Biltmore forestry' program came at the Chicago Columbian Exposition of 1893. Pinchot showed greatly enlarged photographs of what the forest was like and what had already been done to improve it while making it pay. Pinchot said this was "the first exhibition of practical forestry ever made in the U.S. The Biltmore Forest School, designed to train foresters, operated between 1897 and 1913.

The Payseur family had a long history of forestry intrest. In the little town of Lancaster, South Carolina. Lewis Cass Payseur started some of "his" first companies, such as Lancaster Manufacturing Company, which was for manufacturing telegraph poles, shipping crates, railroad ties, matches, turpentine and many other tree- products. It was just the start. Out of that company came such companies as Weyerhaeuser and Crown- Zellerback. Even to t h i s day. you can go to areas in Lancaster where the Payseurs first forests were and see rolls of pine trees that were planted long ago and started as seedlings in egg shells.

317

-

-

THE ANDREW CARNEGIE, STEEL DEAL

In the closing years of the nineteenth century profound changes were taking place in t h e nation. We were like a youth outgrowing a boy's clothes. Our economy was enlarging at such a rate that some industries were seeking more efficient means of production through integrated operations. Large scale production was new on the American scene. It took a wrench in thinking for some people to realize the magnitude of America, and that mass markets require mass production.

A small group of Americans stand out in the late 1890's as men with sufficient vision to foresee the America's future industrial needs could best be served by a more complete integration of steel making operations. Two of the men that were a part of this group were Elbert H. Gary, popularly known as Judge Gary, and Charles M. Schwab. Judge Gary was then president and trustee of the Federal Steel Company, the largest western steel concern. Charles Schwab was directing affairs of the Andrew Carnegie company, then the premier steel producer in the world.

These two men were brought together by the desire of Andrew Carnegie to step down as head of the Carnegie Steel Company of which he had been made Trustee and controller of by the Payseur family who really owned the company. He had become a very wealthy man because of the agreement he had made many years earlier with the Payseur's to be the front man and act as if he was the owner of the company in exchange for a healthy salary plus five percent of the profits of the company.

Around 1900 it became generally known that he wanted to retire and fulfill an often expressed wish to go down in history not as America's greatest steel master but as its greatest philanthropist.

Andrew Carnegie, who more than any one person made Pittsburgh, and Birmingham, famous as great steel cities, he was the son of poor Scottish immigrants. His first job was as a bobbin-boy in a cotton mill for wages of $1.20 a week, and his next was as a telegraph messenger.

Around 1870. a gentleman by the name of Jonas W. Payseur, whose railroad company the Lancaster and Chester Railroad Company owned U.S. Steel had set up another "small" steelworks, in Bessemer. Alabama, entirely out of his own pocket, and had also given over his land to the new company for the entire plant-all in exchange for nine tenths of the preferred shares (45.000 out of the 50.000 total number of preferred shares ever issued) of the steel company. Exchanging land for a new plant to be built on in exchange for nine tenths of the preferred shares of the new company was a standard way of doing business for the gentleman, his father had also created new businesses in this way, and his son was to follow.

Working in another new steel plant of Mr. PayseurY, was a young man who was very quick to learn and the gentleman could see he had a lot of potential in the business world. All he needed was guidance and a little help. The older gentleman approached the young man, and offered him a very generous proposition; given that the gentleman offered to place the young man in charge of the plant, with, of course, the gentleman's personal guidance, and the young man would be made a primary member of the Board of Directors, and thereby could act as if he owned the steel mill, and in return, the gentleman would pay the young man five per cent (5%) of the net profits of the company for life, in addition to his regular (very handsome) salary. The young man agreed, thankful for this magnificent opportunity; the steel mill thereafter took on the young man's last name. Carnegie Steel brought into existence.

When Carnegie stepped down a new president and trustee was appointed, a man whom had been brought up through the ranks, Charles M. Schwab.

324

-

-

COMPANIES OWNED BY THE RAILROADS

Public Utility Companies

Along with the train came the telegraph, and shortly after that came the telephone. (American Telephone and Telegraph (AT&T!). The first Electric (polyphase) generators were invented and patented by Nicola Tesla and very publicly set up at Niagara Falls, giving Buffalo the distinction of being the second city in America to have electric light. The part about the city is correct, but the experiment was tried and tested long before by the building of a dam and power station at Great Falls, South Carolina, which created Southern Power Company (now Duke Power) by the coupling of Tesla's generators (built under license by George Westinghouse, the railroad air brake king), and the patents of the hydro-electric turbines of the Gatling family (yes, those who invented the famous gun), and all this done by and under the Catawba Valley Railway Company (now part of Seaboard Air Line Railway (CSX) on the Catawba River. Meanwhile Thomas Alva Edison invented the 12- volt light bulb for use on the railway carriages of the day under his company, Edison General Electric Company, which company was a division of and sponsored and financed by the railroad which subsequently allowed it to create the electricity distribution system (on and across the railroad lands) which is known today as the "National Grid" (now simply known as G.E., while its subsidiary, Sylvania, makes today's light bulbs, among other things). This also means that wherever the power lines go is railroad land, and therefore part of the property of the original lessor, and so is a percentage of the preferred stock of the division and subsidiary companies. This land ownership by the railroad landlord includes the street in front of your house and part of your front yard. Possibly, all of your property is on railroad-owned land.

Production and Trading Companies

The production giant today known as General Motors came about as a result of the American Association of Automobile Manufacturers, which was an association of such people (men, not companies) as Buick, Chevrolet, Ford. Cadillac, and others, who, together, (Ford is one and the same as General Motors) have cornered a massive market in automobiles, symbol of modernization since their inception in the late 1800's. and not only in the United States. The land for their massive facilities throughout the U.S. and other countries is railroad land, granted to the companies under 99 year leases and sub-leased in exchange for preferred stock. That stock thereby became the property of the original lessor.

Minerals

The cars that General Motors make need fuel. Oil companies must drill for oil, and most oil facilities, both for production and refinement, are within a relative stone's throw of the railway, and invariably (mostly) on odd numbered sections of land. Guess what? Yes! Railroad land. Almost all the oil companies we know today, where they are not some small privately held Texas or Oklahoma style wildcatting company, are either a division or subsidiary of a railroad, which, in exchange for the rights (mineral) or leases, owns 45,000 shares of the preferred stock and holds stock certificate number 1. and the rest of the world owns 5.000 shares of the shares of the oil company.

Also under the lands are many other minerals such as coal, bauxite (aluminum), copper, iron ore (and limestone) etc.. etc., and a i l of the mining companies who wanted to exploit these resources had to lease their lands for buildings, smelting facilities, mines, from the railroad, all again subject to the same rules; preferred stock in exchange for their leases.

On the same land, if not mined by the open face, or pit, or strip mining method, are grown various crops, usually trees. These became the catalyst for the formation of lumber and paper companies. Georgia Pacific (everybody knows that to be also a railroad company). Weyerhaeuser. Crown Zellerback (a division of Mead Inc.) International Paper, and many. many, others. The trees cannot transport themselves to the mills; they go by river, or rail, or road, and the products ship out to the consumer the same way. Trees are a good crop because they take many years (15-40) to grow, therefore, should anyone claim that the railroad or timber

326

company is not using the land and attempt to reclaim it, sorry!—We're farming it-the trees are growing, can't you see????...They'll be harvested in a few years.

Banks, Trust Companies and Insurance Companies

All of the above businesses need two things in order to compete in the "modern world" of both then and now- finance, for expansion and everyday running of the companies, and insurance, because virtually nothing can run today without encountering a law requiring insurance of some kind. Even the Federal Reserve has its own "insurance" of sorts-the FDIC or the FSLIC. Again the insurance companies are a product of the banks, for the banks (and themselves), which again, are a product of the railroads because the total banking system is owned by railroads, long ago the banks were on board the trains that is why they were robbed so much.

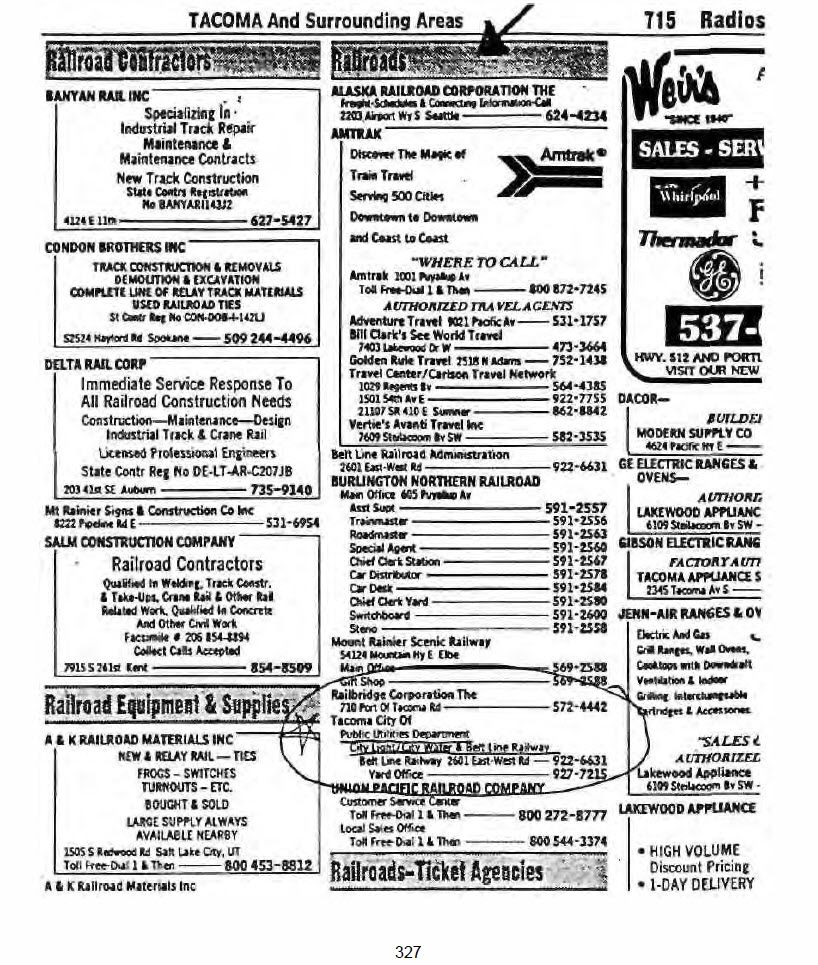

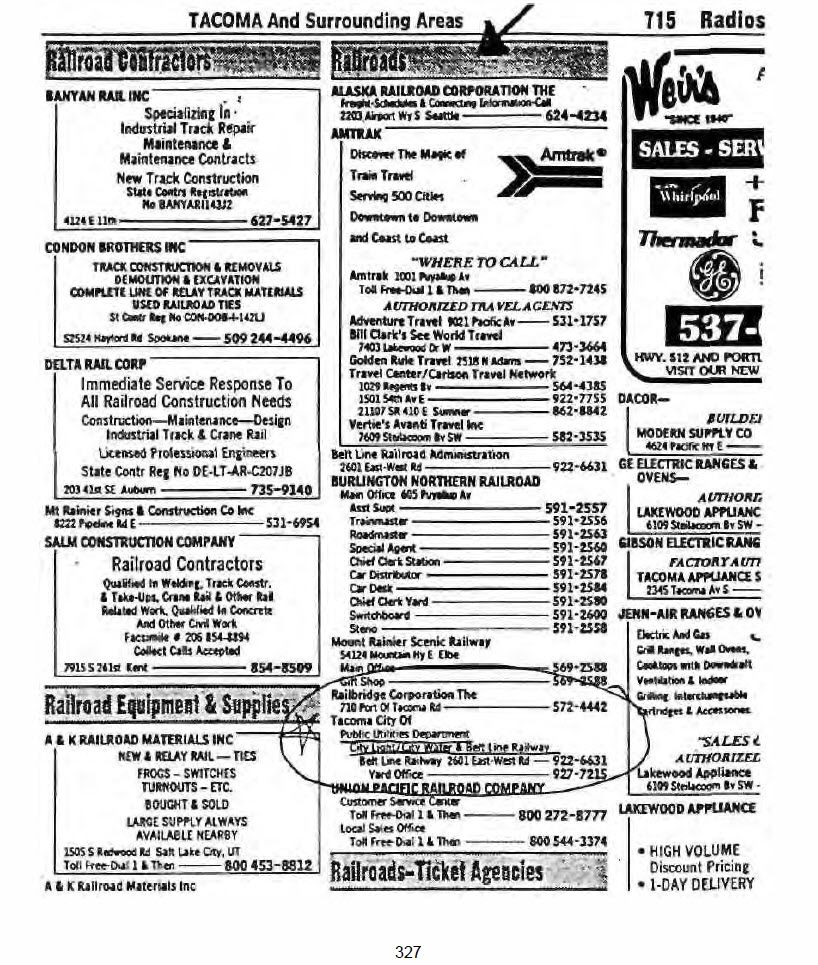

On the following page is an example of common ownership and control of companies as they are jointly listed in the telephone book under railroads.

-

-

RAILROAD OPERATING COMPANIES

Railroads West of the Mississippi River

The principal goal of the government in the construction of the U.S. system of railroads both before and after the Civil War was to create a fast transport system of railroads between Washington, D.C. and New Orleans. Such a system would greatly enhance the abilities of the government to move troops to any arena from the Caribbean waters to the Isthmus of Panama, where there was already a trans.-Panama railroad in existence which would, in turn, allow further transport to the Pacific side, and thereby allow the movements of military and civilian assets up the coast to California and beyond.

The competition was set by the reward.

The first railroad company to achieve a direct l i n k between Washington and New Orleans would be granted the monopoly for the railroads which would thereafter be built from the Mississippi to the Pacific Coast.

This goal was reached shortly after the Civil War with the completion of the Selma, Rome and Dalton Railroad. In one of the court-recorded documents which attests to that particular race from Washington to New Orleans as well as to some of the constituent railroads forming the Selma, Rome and Dalton.

All the railroads which participated in that link-up from Washington to Mobile, thence by boat to New Orleans, had been confiscated under acts of treason, and the railroad companies were lessee operating companies.

The railroads west of the Mississippi were the Northern Pacific. The Union Pacific (which joined up with the Central Pacific coming from San Francisco across the Great Salt Lake flats), the Atchinson, Topeka Santa Fe (formerly the Atlantic & Pacific), and the Southern Pacific Railroad. These railroads exist today in almost the same configuration with the exception that what was the Northern Pacific has been, since March, 1970 entirely incorporated into the Burlington Northern Railway System.

Railroads East of the Mississippi River

Almost all the railroads of the eastern half of the United States were re-organized as a result of the great depression of the early 1890's. Out of that massive series of foreclosures were born the railway companies which became the primary railroad systems known today as Conrail, (Consolidated Railway Company), CSX (Chessie. Seaboard. Much More) and Norfolk Southern.

Conrail

Was chartered in the State of Pennsylvania in 1976 as a result of the Rail Reorganizational Act of 1973 and the amendments to that act of the Railroad Revitalization and Regulatory Reform Act of 1976. It controls and operates over 17.000 miles of railroad track from the Atlantic Ocean to St. Louis and from the Ohio River to Montreal. It is made up of the Penn Central System, the Reading, the central of New Jersey, the Erie & Lackawanna, the Lehigh valley and the Lehigh & Hudson River Railroads, all formerly lessee operating companies and all formerly bankrupt.

This chapter contains a graph with the assets of the Penn Central Railway system at its peak, just after its merger with the New York Central Railroad.

CSX

Is a company created out of the merger, effective on November 1, 1980, of Chessie Systems Inc., and

Seaboard Coast Line Industries Inc. (SCLI), and it claimed, in 1980, approximately S7.4 b illion in assets.

330

Chessie Systems is a company created out of the merger of the Chesapeake and Ohio, the Baltimore and Ohio, the Western Maryland, the Baltimore and Ohio Chicago Terminal Railroad, the Staten Island Railroad, and the Chicago, South Shore and South Bend Railroad.

Seaboard Coast Line Industries is a holding company comprised of the Seaboard Coast Line Railroad (which is a massive company created by the merger on July 1. 1967 of the Seaboard Air Line Railway and the Atlantic Coast Line Railroad), the Louisville and Nashville, the Clinchfield, the Georgia Railroad and Banking Company (owner of the Atlanta and West Point Railroad, and co-owner of the Western Railway of Alabama), the Durham and Southern, the Gainesville Midland, the Carrollton and Columbia and the Newberry and Laurens Railroads.

All the Companies comprising the CSX group of railroads are lessee operating companies only.

Norfolk Southern

In 1980, the Norfolk & Western Railroad Company, by its merger with Southern Railway Company created a system of railroads which boasted 32,000 miles of track age, $5.7 billion in assets, and collective earnings in

1979 of $100 million.

Norfolk & Western Railway

Norfolk & Western Railway was originally a lessee and operating company created out of the foreclosure and reorganization of the Atlantic, Missouri and Ohio Railroad in 1896, and it presently controls more than 15,000 miles of railroad. The original railroad was enlarged by a series of mergers with other companies, which include, but are not limited to, the Virginian, the Wabash, the Nickel Plate, the Akron, Canton and Youngstown, The Pittsburgh and West Virginia, the Sandusky Line of the Pennsylvania System, the Carolina and Northwestern, and the Delaware and Hudson Railroads.

Southern Railway

Southern Railway was created on June 18, 1894 as the lessee operating company (out of the foreclosure against the Richmond and Danville Railroad) for a series of railway companies, and it currently controls more than 17,000 miles of track age.

The list of Railroads that were merged into Southern Railway are as follows: GEORGIA MIDLAND RAILWAY

CINCINNATI AND GEORGIA RAILROAD

RICHMOND AND MECKLENBURG RAILROAD CLARKVILLE AND NORTH CAROLINA RAILROAD MOBILE AND BIRMINGHAM RAILROAD ALABAMA CENTRAL RAILROAD

ATLANTIC AND DANVILLE RAILWAY

LACKHART RAILROAD

SOUTH CAROLINA AND GEORGIA RAILROAD CHARLOTTE. COLUMBIA AND AUGUSTA RAILROAD ASHEVILLE AND SPARTANBURG RAILROAD WESTERN NORTH CAROLINA RAILROAD

COLUMBIA AND GREENVILLE RAILROAD

SOUTH CAROLINA AND GEORGIA EXTENSION RAILROAD CAROLINA MIDLAND RAILWAY

ATLANTIC COAST LINE RAILROAD

In 1902 the following Railroads were merged into the Atlantic Coast

Richmond and Petersburg

Petersburg Railroad

331

Cheraw and Darlington Northeastern Railroad Manchester and Augusta Florence Railroad Wilington and Weldon Norfolk and Carolina Southeastern Railroad Charleston and Savannah Brunswick and Western Alabama Midland Railroad

Silver Springs, Ocala and Gulf Tampa and Thonotossa Savannah, Florida and Western Ashley River Railroad

Abbeville Southern Railway

Southwestern Alabama Railway

SUMTER AND WATEREE RIVERS RAILROAD TRANSYLVANIA RAILROAD

KENTUCKY AND INDIANA BRIDGE AND RAILROAD COMPANY

BALTIMORE AND OHIO SOUTHWESTERN RAILROAD CHICAGO, INDIANAPOLIS AND LOUISVILLE RAILWAY RICHMOND, FREDERICKSBURG AND POTOMAC RAILROAD WASHINGTON SOUTHERN RAILWAY

PENNSYLVANIA RAILROAD

CHESAPEAKE AND OHIO RAILWAY SEABOARD AIR LINE RAILWAY BALTIMORE AND OHIO RAILROAD WHITNEY BRANCH

YADKIN RAILROAD

LOUISVILLE AND NASHVILLE RAILROAD

KNOXVILLE, CUMBERLAND GAP AND LOUISVILLE RAILWAY MIDDLESBOROUGH RAILROAD

BENNETTS FORK BRANCH

KNOXVILLE, LaFOLLETTE AND JELLICO RAILROAD CUMBERLAND RAILWAY

332

-

-

THE DOMINATED CONTROL OF MONEY AND CREDIT REPORT OF THE PUJO COMMITTEE

1913

U.S. 62d congress, 3rd. Session, House Report, No. 1593

Chapter III

From Private Records

The control of the railroads and money, including credit for individuals and for companies is at best addressed by The United States of America in it's attempt to gaze into the "Inner Group" which is now being handed to you as a result of the murder threats by the presently "corrupted inner group" hereinafter referred to as "White Collar Crimes", to which is stipulated that this letter and these IRS form 211 reports are in continuation of the matters then addressed by the 62nd Congress 3rd Session, December 2, 1912 through March 4, 1913 and contained in Volume "F" designated as "Private Mouse Reports." House Calendar 424, to wit:

"Report of the Committee Appointed Pursuant to House Resolutions 429 and 504 to Investigate the

Concentration of Control of Money and Credit, submitted by Mr. Pujo, February 28, 1913.

While it is known and proven that Mr. Pujo was on the right path, it is also known and proven that neither he nor his committee knew how to get into the "Inner Group" to obtain the truth, and about all they obtained was the outside information of what was thought to be the inside information, and this is clearly traced throughout this Congressional Committee Report, especially when associated to the railroad Inner Group. To the premise. Pointed out on page 147 of that "Private" Report, that it specifies, to Wit:

"Section 10. - Domination of Railroad Systems by Inner Group. Your committee finds that vast systems of railroads in various parts of the country are in effect subject to the control of t h i s inner group, a situation not conductive to genuine competition.

Here again the Southern Railway offers the most convenient illustration. For 19 years it has been controlled by

Messers. Morgan and Baker under a voting trust. They still control it.

It operates in competition with the Louisville & Nashville and with the Atlantic Coast Line Railroads. While under such control Messers. Morgan & Co. purchased the Louisville & Nashville and turned it over to the Atlantic Coast Line, thus strengthening the latter against the competitor for whose stockholders Messers. Morgan and Baker were acting as trustees, and whose properties were in their hands.

During this same time, while Messers. Morgan & Co. had been financing the requirements of the Southern

Railway, they have also been financing those of its competitor.

Your committee is of the opinion that such affiliations as are here shown to exist with competing enterprises are not wholesome, that they do not promote competiiion. but on the contrary tend as a cover and conduit for secret arrangements and understanding in restriction of competition through the agency of the banking house thus situated.

Section 11 - Railway Reorganizations as an Instrument of concentration. Our archaic, extravagant, and utterly indefensible procedures for the reorganization of insolvent railroads has furnished these banking groups the opportunities of which they have not been slow to avail themselves, of securing the domination relation that they now hold to many of our leading railroad systems. At one lime or another w i t h i n the past 30 years the hulk of our railways have gone through insolvency and receivership. The proceedings are sometime instigated by the management through a friendly creditor (and are then generally collusive in their inception) or through the trustee for bondholders with the cooperation of the company. The railway company admits its insolvency, consents to the receivership- and one or more of the officers under whose administration in solvency was brought about: or their nominees, is made a receiver, and sometimes the sole receiver. Neither creditors nor stockholders, who are the parties really interested, are notified or have an opportunity to be heard either on the question of insolvency or of t h e personnel of the receivers. The stage has been set in advance, and so we find that simultaneously either the appointment of t h e receivers, or perhaps before, a self-constituted committee is

334

announced, frequently consisting of men well known in the financial world, most of whom have no interest in the property, selected by a leading banking house. They invite the deposit of securities for mutual protection.

If the security holders do not l i k e it. their only alternative is to form another committee, if they can arrange to combine their scattered forces and find influential men who have the courage to oppose the banking house and who can finance the cash requirements of these colossal transactions in hostility to the banking house that was first in the field. It is not easy to find such men."

This part of the "Pujo Report" is dead on target, but in the report, Mr. Pujo was trying to prove and could not prove that Mr. J.P. Morgan was the controlling party, which he was not. J.P. Morgan was the Banker-Trustee for Lewis Cass Payseur, owner of these various railway companies, detailed to the premise in the Voting Trust and in the United States Circuit Court, Distinct of South Carolina. 63 F. 21 Clyde et al, v. Richmond and Danville Railroad Company et al, Central Trust Company of New York v. same Ex parte Chester and Lenoir Narrow Gauge Rail Road Company Ex parte Harden, August 9, 1894. We have now filed legal action against the present railroad tenant, CSX Transportation, whereas it is Federal Tax Fraud for a tenant to depreciate the owner's estate, and according to the old records Lewis Cass Payseur has never sold his railways and railroads, but they are LEASED for 99 years, Southern Railway Company, ending 17 June 1993, and Dec. 31, 1995 with J, P. Morgan as the Banker- Trustee under a Voting Trust instrument.

Between 1885 and the turn of the 20th century, Congress tried ineffectively to regulate the activities of what it perceived as a fast-growing monopolistic monster: the railroads and their attendant industrial complex. The first effort at such regulation was the passing of the Sherman Anti-Trust Act of 1885, followed by the Interstate Commerce Act of February 4, 1887 and, later, "An Act to protect Trade and Commerce against unlawful Restraints and Monopolies", of July 2, 1890, all of which were designed to break up the monopolies controlled by the railroads and their attendant businesses. The politically expedient excuse was that this colossus was controlling the money supply itself, by locking up free money and allowing its use only by its own "member" companies and entities. In 1912 Congress ordered an investigation into this monopolistic industrial empire. Refer to the chapter on the Federal Reserve.

The one thing that is not mentioned anywhere is that the railroads that were organized before and during some of the early Anti-trust Acts formations actually had "Immunity" to the anti-trust laws, so they have been operating anyway they liked up until the new anti-trust laws started being created in the 1970s'. And because of the flurry of new laws and amendments to old anti-trust laws all the companies, railway and others are all in violation of anti-trust laws. They are doing company shut down, cutbacks and lay ojfs. It appears that they plan to just stop operating the companies in the united states and move the companies into the third world nations which they now control. Because the leases in the united states are about to end and the railroads operating companies, not the railroad owner, are trying to sell off all of the railroad land and property they possibility can. pocket the money and leave the country. The operating companies have not fulfilled their lease agreements. In many cases the way the leases were written, about 100 years ago, all of the federal excise taxes for production of merchandise in all the railroads and their subsidiary owned companies have been rolled to the last day of the lease. Who ever is on the land or property which was originally every "odd section" and in some states a portion of the "even sections" of land in the united states of America, at the end of the lease is liable for 100 years of federal excise taxes, if the railroad leases are not renewed. People that have homes on former or current railroad property may get hit with high tax bills soon, or tax fraud for their having deprecated the property while inhabiting the property.

Summery of the Pujo Report

Ever since the publication of Henry D. Lloyd's Wealth Against Commonwealth in 1894, the charge that a small group of money masters controlled American industry, transportation and credit, had gained acceptance. With the muckraking campaign of the first decade of the new century, this charge was substantiated in many details and given wide popularity. In February 1912, the House of Representatives directed the Committee on Banking and Currency to investigate banking and currency with a view toward necessary legislation. A subcommittee, headed by Arsene P. Pujo, investigated banking abuses. The chief examiner of the Pujo committee was Samuel Untermeyer of New York. The material unearthed by the Pujo committee was valuable for the campaign of 1912 and served to strengthen the hands of the reformers in the first Wilson administration.

335

The "Pujo Report", contained 258 pages and three charts (graphics) of the interlocking relationships between live principal banking houses and almost all the railroads in existence in the United States at that time, along with the 22.245 billion dollars worth of assets which could be traced concerning those companies and banking institutions.

Pujo's main admitted problem in discovering those assets and worth was created from the fact that he had to go through several layers of trust, holding companies, associations and voting trusts to find out who were the real owners of the giants, and he admitted that with all the resources behind him, he could not even force the persons encountered to give him the information he needed to complete the investigation, which necessitated his asking Congress to allow h i m greater freedoms and powers of action, which was be grudgingly given him by House Resolution 504. Even after the new powers were granted, he still complained of his inability to find all the interlocking relationships, let alone being able to determine the real owners. He attributes the control (implying real ownership) to the man who seemingly foiled his best attempts at discovering the truth: Mr. John Pierpont Morgan, head of the voting trusts, and principal trustee and mortgagor to all of the companies in the huge conglomerate.

Pujo was able to discover some of the interlocking relationships between the banking and trust houses and the various companies, and also the interlocking directorships and trusts which he asserted controlled the newly discovered empire. He was also able to determine, at least some, if not a l l the information the true net value of the companies and their incomes and asset. From this sparse information, he concluded that the directors and trustees who he named in the report had control over assets worth approximately $22,245,000,000. Through the normal course of inflation, let alone the growth of the companies themselves, the value of these assets today can only be wildly guess. The one thing that always alluded Pujo's search was that (l)one little lone French man owned and controlled all that he was investigating and that the mans name was Lewis Cass Payseur and (2) J.P. Morgan was his front man and trusted friend.

The following is a brief over view of just some of the highlights of the 258 page report prepared by the committee.

The resources of the banks and trust company of the city of New York on 1911 were $5,121,245,175, which is 21.73 per cent of the total banking resources of the country as reported by the comptroller of the currency. This takes no account of the unknown resources of the great private banking houses whose affiliations to the New York financial institutions we are about to discuss.

That in recent years concentration of control of the banking resources and consequently of credit by the groups to which we will refer has grown a place in the city of New York is defended by some witnesses and regretted by others, but acknowledged by all to be a fact.

From statistics compiled by accountants for the committee, in 1911, of the total resources of the banks and trust companies in New York City, the 20 largest held 42.97 per cent; in 1906, the 20 largest held 38.24 per cent of the total; in 1901, 34,97 percent.

Section 3- Processes of Concentration

The increased concentration of control of money and credit was effected principally as follows:

First, consolidation of competitive or potentially competitive banks and trust companies were brought under sympathetic management.

Secondly, the same powerful interests became large stockholders in potentially competitive banks and trust companies. This is the simplest way of acquiring control, but since it requires the largest investment of capital, it is the least used, although the recent investments in that direction for that apparent purpose amount to tens of millions of dollars in present market values.

Third, the confederation of potentially competitive banks and trust companies was accomplished by means of a system of interlocking directorates.

336

Fourth, the influence which the more powerful banking houses, banks, and trust companies secured in the management of insurance companies, railroads, producing and tracing corporations, and public utility corporations, by means of stockholding, voting trust, fiscal agency contracts, or representation upon their boards of directors, and through supplying the money requirements of railway, industrial, and public u t i l i t i e s corporations, enabled to participation in the determination of their financial and business policies.

Fifth, partnership or joint account arrangements between a few of the leading banking houses, banks, and trust companies in the purchase of security issues of the great interstate corporations, accompanied by understandings of recent growth, sometimes called "banking ethics." had the effect of effectually destroying competition between such banking houses, banks, and trust companies in the struggle for business or in the purchase and sale of large issues of such securities.

Section 4 Agents of concentration

It is a fair deduction from the testimony that the most active agents in forwarding and bringing about the concentration of control of money and credit through one or another of the processes above described have been and are:

J.P. Morgan & Co.

First National Bank of New York

National City Bank of New York

Lee, Higginson & Co., of Boston and New York

Kuhn, Loeb & Co.

In other words, the combined power of Morgan & Co., the First National, and National City Banks. In earlier pages of the report the power of these three great banks was separately set forth. It is now appropriate to consider their combined power as one group.

First-Banking Resources:

The total resources of Morgan & Co. are unknown; its deposits are $163,000,000. The resources of the First

National Bank are $150,000,000. and those of its appendage, the First Security Co., at a very low estimate, are

$35,000,000. The resources of the National City Bank are $274,000,000. Those of its appendage, the National City Co.. are unknown, though the capital of the latter is alone $10,000,000. Thus, leaving out of account the very considerable part which is unknown, the institutions composing this group have resources of upward of $632,000,000. aside from the vast individual resources of Messers. Morgan. Baker, and Stillman.

Further, as heretofore shown, the members of this group, through stock holdings, voting trust, interlocking directorates, and other relations, have become in some cases the absolutely dominant factor, in others the most important single factor, in the control of the following banks and trust companies in the city of New York:

-

-

Bankers Trust Co.

resources $250,000,000. Guaranty Trust Co.

resources 232,000,000.

Astor Trust Co.

resources 27,000,000. National Bank of Commerce

resources 190,000,000.

Liberty Nation Bank

resources 29,000,000. Chase National Bank

resources 150,000,000.

Farmers Loan and Trust Co.

resources 135.000.000. In all. seven companies with total resources of: $968,000,000.

337

which, added to the known resources of members of the group themselves, makes:

As the aggregate of known banking resources in the city of New

York under their control or influence.

If the resources of the Equitable Life Assurance Society (controlled through stock ownership of J.P. Morgan.

$1,600,000,000.

$504.000.000.

the amount becomes: $2,104,000,000. Second, as regards t h e greater transportation systems.

(a) Adams Express Co.: Members of the group have two representatives in the directorate of this company.

(b) Anthracite Coal Carriers: With the exception of the Pennsylvania, the Reading, The Central of New

Jersey ( a majority of whose stock is owned by the Reading ), the Lehigh valley, the Delaware, Lackawanna

& Western, the Erie Railroad ( controlling the New York Susquehanna & Western), and the New York,

Ontario & Western afford the only transportation outlets from the anthracite coal fields. As before stated. they transport 80 per cent of the output moving from the mines and own and control 88 per cent of the entire deposits. The Reading, as now organized, is the creation of a member of this banking group-Morgan&Co. One or more members of the group are stockholders in that system and have two representatives in its directorate; are stockholders of the Central of New Jersey and have four representatives in its directorate; are stockholders of the Lehigh Valley and have four representatives in its directorate; are stockholders of the Delaware, Lackawanna & Western and have nine representatives in its directorate; are stockholders of the Erie, and have four representatives in its directorate: have two representatives in the directorate of the New York, Ontario & Western; and have purchased or marketed practically a l l security issues made by these railroads in recent years.

(c) Atchison, Topeka & Sante Fe Railway: One or more members of the group are stockholders and have two representatives in the directorate of the company; and since 1907 have purchased or procured the marketing of its security issues to the amount of $107,244,000.

(d) Chesapeake & Ohio Railway: Members of the group have two directors in common with this company ; and since 1907, in association with others, have purchased or procured the marketing of its security issues to the amount of $85,000,000.

(e) Chicago Great Western Railway: Members of the group absolutely control this system through a voting trust.

(0 Chicago, Milwaukee & St. Paul Railway: Members of the group have three directors or officers in common with this company, and since 1909, in association with others, have purchased or procured the marketing of its security issues to the amount of $112.000,000.

(g) Chicago & Northwestern Railway: Members of the group have three directors in common with this company, and since 1909, in association with others, have purchased or procured the marketing of its security issues to the amount of $31,250,000.

(h) Chicago, Rock Island & Pacific Railway: Members of the group have four directors in common with this company.

(i) Great Northern Railway: One or more members of the group are stockholders of and have marketed the only issue of bonds made by t h i s company.

(j) International Mercantile Marine Co.; A member of the group organized this company, is a stockholder, dominates it through a voting trust, and markets its securities.

338

(k) New York Central Lines: One or more members of the group are stockholders and have four representatives in the directorate of the company, and since 1907 have purchased from or marketed for it and its principal subsidiaries security issued to the extent of $343.000.000, one member of the group being the company's sole fiscal agent.

(l) New York, New Haven & Hartford Railroad: One or more members of the group are stockholders and have three representatives in the directorate of the company, and since 1907 have purchased from or marketed for it and its principal subsidiaries security issued in excess of $150,000,000. one member of the group being the company's sole fiscal agent.

(m) Northern Pacific Railway: One member of the group organized this company and is its fiscal agent, and one or more members are stockholders and have six representatives in its directorate and three in its executive committee.

(n) Southern Railway: Through a voting trust, members of the group have absolutely controlled this company since its reorganization in 1894

(o) Southern Pacific Co: Until its separation from the Union Pacific, lately ordered by the Supreme Court of the United States, members of the group had three directors in common with this company.

(p) Union Pacific Railroad: Members of the group have three directors in common with this company. Third, as regards the greater producing and trading corporations.

(1) Amalgamated Copper Co.: One member of the group took part in the organization of the company, still has one leading director in common with it, and markets its securities.

(2) American Can Co.: Members of the group have two directors in common with this company.

(3) J. L. Case Threshing Machine Co.: The president of one member of the group is a voting trustee of this company and the group also has one representative in its directorate and markets its securities.

(4) William Cramp Ship & Engine Building Co.: Members of the group absolutely control this company through a voting trust.

(5) General Electric Co.: A member of the group was one of the organizers of the company, is a stockholder, and has always had two representatives in its directorate and markets its securities.

(6) International Harvester Co.: A member of the group organized the company, named its directorate and the chairman of its finance committee, directed its management, through a voting trust, and markets its securities.

(7) Lackawanna Steel Co.: Members of the group have four directors in common with the company and, with associates, marketed its last issue of securities.

(8) Pullman Co.: The group has two representatives, Mr. Morgan and Mr. Baker, in the directorate of this company.

(9) United States Steel Corporation: A member of the group organized this company, named its directorate, and the chairman of its finance committee which also has the powers of an executive committee is its sole fiscal agent and a stockholder, and has always controlled its management.

Fourth, as regards the great public utility corporations:

(I) American Telephone and Telegraph Co.: One or more members of the group are stockholders, have three representatives in its directorate, and since 1906, with other associates, have marketed for it and its subsidiaries security issued in excess of $300,000,000.

339

(2) Chicago Elevated Railways: A member of the group has two officers or directors in common with the company, and in conjunction with others marketed for it in 1 9 1 1 security issues amounting to $66,000,000.

(3) Consolidated Gas Co. of New York: Members of the group control this company through majority representation on its directorate.

(4) Hudson & Manhattan Railroad: One or more members of the group marketed and have large interest in the securities of this company, though its debt is now being adjusted by Kuhn. Loeb & Co.

(5) Interborough Rapid Transit Co. of New York: A member of the group is the banker of this company, and the group has agreed to market its impending bond issue of $170,000,000.

(6) Philadelphia Rapid Transit Co.: Members of the group have two representatives in the directorate of this company.

(7) Western Union Telegraph Co.: Members of the group have seven representatives in the directorate of this company.

340

The following is a list of the remaining companies that were owned by Lewis Cass Payseur and controlled by the Morgan Trust that the committee could find:

American Exchange National Bank of New York Bank of Manhattan Company of New York Central Trust Company of New York

Chemical National Bank of New York

Equitable Trust Company of New York Fourth National Bank of New York Hanover National Bank of New York

Mechanic and Metal National Bank of New York National Bank of Commerce of New York National Park Bank of New York

New York Trust Company of New

Union Trust company of New York

U.S. Mortgage and Trust Company of New York United States Trust Company of New York American Security Trust company of Washington Riggs National Bank of Washington

Mellon National Bank of Pittsburgh, Pa. Union Trust Company of Pittsburgh, Pa. Fourth Street National Bank of Philadelphia Franklin National Bank of Philadelphia Girard Trust Company of Philadelphia Philadelphia National Bank of Philadelphia Central Trust Company of Chicago

Continental and Commercial National Bank of Chicago

Continental Commercial Trust and Savings

First National Bank of Chicago

First Trust and Saving Bank of Chicago Illinois Trust and Savings Bank of Chicago Merchants Loan and Trust Company of Chicago American Surety Company

Continental Insurance Company

Fidelity and Casualty Company Carman American Insurance Company Home Insurance Company

Mutual Life Insurance Company New York Life Insurance Company Northwestern Mutual Life

Penn Mutual Life Insurance Company Baltimore and Ohio Railroad Company Delaware and Hudson Railroad Company Denver and Rio Grande Railroad Company I l l i n o i s Central Railroad Company

Missouri, Kansas and Texas Railroad Company

Missouri Pacific Railroad Company Norfolk and Western Railroad Company Seaboard Air Line Railroad Company Wabash Railroad Company

Wells Fargo and Company

■^

341

American Agriculture and Chemical Company

American Beet Sugar Company American Car and Foundry Company American Locomotive Company

American Smelting and Refining Company American Sugar Refining Company Armour and Company

Baldwin Locomotive Works Central Leather Company Intercontinental Rubber Company International Agriculture Corp. International Nickel Company International Paper Company National Biscuit Company

U. S. Rubber Company

Westinghouse Electric and Mfg.Co. Public Utilities Companies

(1) American Light and Traction Co.

(2) American Telephone and Telegraph

(3) Chicago Elevated Railways

(4) Commonwealth Edison Company

(5) Consolidated Gas Company

(6) Intarboro Transit

(7) International Tract Co. (8) New York Railway Co. (9) Philadelphia Co.

(10) Philadelphia Rapid Transit Co.

(11) Public Service Corporation of New Jersey

(12) United Gas Co.

(13) Puget Sound Electric Co.

A summary' of directorships held by these members of the group. The combined directorships in the more important enterprises held by Morgan & Co., the First National Bank, the National City Bank, and the Bankers and Guaranty Trust Co. which latter two, as previously shown, are absolutely contorted by Morgan and Co. through voting trust. It appears there that firm members or directors of these institutions together hold: One hundred and eighteen directorships in 34 banks and trust companies having total resources of $2.679,000,000 and total deposits of $1. 983.000.000.

Thirty directorships in 10 insurance companies having total assets of $2,293,000,000.

One hundred and five directorships in 32 transportation systems having a total capitalization of

$11,784,000,000 and a total mileage (excluding express companies and steamship lines) of 150,200.

Sixty-three directorships in 24 producing and trading corporations having a total capitalization of

$3.339.000.000.

Twenty-five directorships in 12 public utility corporations having a total capitalization of $22,245,000,000.

In all. 341 directorships in 112 corporations having aggregate resources or capitalization of $42,340,000,000. The members of the firm of J.P. Morgan & Co. held 72 directorships in 47 of the greater corporations; George F. Baker, chairman of the board, F.L. Hine, president and George F. Baker, Jr. and C. D. Norton. Vice presidents, of the First National Bank of New York, hold 46 directorships in 37 of the greater corporations: and James Stillman, chairman of the board, Frank a Vanderlip, president, and Samuel McRoberts, J. T. Talbert. W.A. Simonson, vice-presidents, of the National City Bank of New York, hold 32 directorships in 26

342

of the greater corporations; making in a l l for these members of the group 150 directorships in 110 of the greater corporations.

The committee never could get past the voting trust, to break the vail of secret ownership to all these companies plus many more there were 364, plus many more that were all owned by the Payseur family. Cross reference this list of companies with the chapter of "Assets of Lewis Cass Payseur" that were filed for probate in Alabama.

343

-

-

FEDERAL TRADE COMMISSION ACT OF 1914

The Federal Trade Commission Act, passed September 26, 1914. The Sixty-Third Congress Session II Chapter 311, states in simple terms that it was to establish a five member commission to keep an eye on all big corporation (except banks and common carrier, railroads) engaged in interstate or foreign trade. It was required to publish violations and abuses and enforce the laws against unfair competition.

The Clayton Anititurst Act, 1914, was framed to help the government further close in on the trusts. It listed in detail all the practices condemned by the courts: especially it forbade rebates, secret agreements, price privileges and interlocking directorates between banks, railroads, coal companies, etc.. It said that the labor of a human being is not a commodity and exempted from anti-trust laws all nonprofit making labor and farm groups.

This information is meant to show that the government is aware of the monopolies of the banks and railroad that was owned by the Payseur family and is saying that we must keep and eye on everything else except these because we can't do anything about the banks and railroads.

-

-

THE TRUE FEDERAL RESERVE STORY

Many of you have read elements of history recounted by Ralph Epperson, Eustace Mullins and Linsey Williams, but what you must realize is that none of these authors knew the information behind the events they describe; as a result, their work amounts to superficial coverage at best. You are advised to get a good grip on your armchair, because you are about to see in print, for the first time, information about the Federal Reserve that has never seen the light of day.

In 1893 a panic, which was engineered by the Railroad Bankers, was in progress. The gold reserve in the U. S. Treasury held only $80 million, far too little for the United States to go on redeeming currency in gold. President Cleveland called a special session of Congress in Aug. 1893. To repeal the Silver Purchase Act that was depleting the reserve. He was hotly opposed by the silver contingent of his own party. The Act was repealed, but no legislation was made to protect the reserve in any other way.

People began to hoard gold. Business' failed and banks crashed everywhere. National bank deposits fell S378 million. The silver dollar dropped from $.67 to $.60 in value; the western silver mines shut down. By winter (1893-94) everything was worse. Thousands were jobless: hundreds starved. Coxey's Army, a spectacular horde of the unemployed, marched to Washington to plead redress. They arrived in front of the White House May 1, 1894, but all the government could do was arrest them for walking on the grass!

Workers in the Pullman Car Co., Chicago, struck in protest against cut wages. The strike spread to 27 states and involved 23 railroads. Railroad property, cars and buildings, were burned, trains were stopped, the mails obstructed. True history has probably been covered up. The people of this era possibly knew who was behind the control of money and were rebelling. Gov. Altgeld of Illinois, who sympathized with the strikers, would do nothing. But President Cleveland sent Federal troops to quell the agitation and keep the mail moving. The U.S. Supreme Court, by injunction, forbade interference with the movement of trains. There was bloodshed and war between the troops and the strikers. Peace was restored by the end of July 1894. But Cleveland's interference cost him the support of organized labor and its sympathizers.

The whole 1893-94 panic and everything was planned so that the Payseur family, acting on behalf of the Virginia Company, could at last take total control of every railroad and railroad banking concern in this county. Remember the family held the financial notes for construction of the railroads, rails, rolling stock etc. They had taken the congressionally granted railroad land grant patents as collateral for the debt the railroad company owed the Payseur banks of New York for building the railroads. By orchestrating a financial crash in this county the railroads could not pay their notes and a l l railroad companies were seized by the banks in foreclosure. The Payseurs became the absolute owner and then they turned around and J. P. Morgan. L. C Payseurs' head trustee, created a plan to lease a l l the railroad companies out to operating companies in the form of the Southern Railroad Lease of 1894.

Just to refresh vour memory, as you alreadv have discovered in earlier chapters, the railroad owns most every odd section of land in the United States and bought many even sections of land too. Along with this, they got the mineral rights also and the list goes on.

This means that the landlord, Lewis Cass Payseur, owned all of the minerals in the ground everywhere. He also had railroad land and other claims, including gold and silver deposits. The family already had a federal monopoly for the control of railroads and banks, and had the desire to make the United States dollar the strongest form of money in the world by continuing to back all the currency in the United States with gold and silver all of which he owned, anyway.

This family has, even to t h i s day, away of creating companies years in advance and then getting laws written to prevent anyone else from infringing on their monopoly.

In 1894. a seemingly inconspicuous company was formed in North Carolina; it was incorporated, The North Carolina Gold Company, a body politic and corporation, this document is included in this chapter. Which means that it is a private company and is owned by an individual person or persons. In this case a person.

350

This little company was owned by a railroad by the name of The Charleston, Cincinnati and Chicago Railroad. Which was also the owner of some thirty-six banking houses. The Charleston, Cincinnati and Chicago Railroad is a wholly owned subsidiary of the Lancaster and Chester Railroad Company.

A secret meeting took place in November of 1910, in a little tucked away place by the name of Jekyll Island in Georgia at a hunt c l u b propertied to have been owned by none other than J.P. Morgan. Infact, it was a private club owned by the railroad owner Lewis Cass Payseur, who had a passion for hunting, especially duck hunting.

Some of the people that attended were A. Piatt, Frank Vanderlip, Henry P. Davison, Charles D. Norton, Benjamin Strong, Paul Warburg and Nelson Aldrich. You w i l l notice that there is no mention of a Rothschild in this list, because at that time the Rothschilds were not involved with the Federal Reserve plan; it was not until sometime later that the Rothschilds became involved with it and only then because of the death of Lewis Cass Payseur in 1938. and the subsequent embezzlement by the Rothschild cousins-the Leroy Springs family decedents.

It was only natural that J. P. Morgan would be pushing the passage of the Federal Reserve Act. because he was the main trustee for all of the Payseur companies that had been placed into trust with Morgan. The other men that were involved with the Jekyll Island trip were all life estate trustees for the Payseur family dynasty. Remember that the Payseurs had a monopoly on banking in America, which meant all of them fell under their control in some manner.

Congressman Lindberg, testifying before the Committee on Rules, December 15, 1911, after the Aldrich plan to put the Federal Reserve into place had been introduced in Congress, said:

"Our financial system is a false one and a huge burden on the people. I have alleged that there is a Money Trust. The Aldrich plan is a scheme plainly in the interest of the Trust. Why does the Money Trust press so hard for the Aldrich Plan now, before the people know what the money trust has been doing?"

Lindbergh was right. It was to become the largest money trust ever. It became another part of the secret hidden trust that is part of the power- control in the world, which goes back to the original Virginia Company and is a sibling of the Federal Reserve of England. The Federal Reserve Bank as it is known today is one of the banks owned by the the Charleston, Cincinnati and Chicago Railroad. The Fed is comprised of 1503 congressional districts and 364 of the referenced Fortune-500 companies owned by the Payseur monster that been leased out on a 99 year lease soon to be up on the dates of June 17, 1993 and December 31, 1993. If, by some wild stroke of luck, the people wake up in time to take the power back or we have new tenants lease all of this and take the control away from the tyrants that are now in control, things might start to change. There are no promises being made for a brighter future. The tyrants that control the Fed and the other trust companies once controlled by J. P. Morgan are very powerful. What I am telling you here is not hard to see if you only open your eyes and ears and start putting this giant puzzle together; it is the truth given to you for the very first time, and can be proven with court house and federal documents and not by the half-baked ideas by those that only read the newspapers and history books that have and are written by the ones that have been in control for a very long time.

The enormous national debit load that this country is laboring under was created out of nothing for something that is nothing. The Federal Reserve charges the United States interest on the paper money, and their form of banking system that is almost exclusive to the federal reserve bank. It is called a, "Reg. "Y" Instrument" that are almost extent now, that is why the New York banks, (that are railroads), which were grandfathered into that system have a 15 to 1 ratio in banking it is called fractional reserve banking creating something out of nothing. The banks that operate on the "Reg. Y" principle can write checks fifteen times over for every' dollar they are holding. That is power. And we have to pay interest on the excess money that the fed prints to cover the fifteen dollars that are created from every one dollar that is really held by the bank.

Today there is supposed to be a man by the name of Greenspan directing the affairs of the Federal Reserve, but this is not the truth of the matter. The person that controls the Federal Reserve and the rest of the world is the decedent of Leroy Springs, his great-great grand daughter Crandal Close Bowles, who sits as director in the Federal Reserve building in Charlotte, North Carolina.

351

The Involvement of the Payseur and Beatty families in the printing of the Federal Reserve notes

Let us review some past history of the Payseur and Beatty families. The year is 1757; a paper manufacturer by the name of Beatty invented a special woven type of paper called "Chameleon Paper". The paper was extremely durable, readily accepted special magnetic inks, and contained a unique mix of almost microscopic fibers, most white, some red, some green. The Beatty paper mill was on the Yadkin River in North Carolina still produces this special paper today, and it is the sole supplier, under great secrecy, to the Federal Reserve printing mills. It is the paper from which the currency of the United States of America is made. In 1913, the Federal Reserve Bank, caused legislation to be enacted to the effect that it would be thereafter illegal to even attempt to make a paper like it. The Payseur family bought this paper mill after the Civil War because that the Beatly's lost everything for acts of treason. The Payseurs in later years found a use for this very special paper, and in fact one of the Payseur family elders told an interesting story one day about how when she was a young girl and her family was l i v i n g in Washington D.C. with her grandfather L.C. Payseur, there was a special section in the house that she would visit that had been converted into a printing company, which her uncle operated, to print the money that was to soon come into use in the United States; the year was around 1909, and the inscription on the money said, "Federal Reserve Note". It is unknown when or if those bills were ever put into circulation.

The Federal Reserve has to do with the covenant of the

Virginia Company

For the grants of the land known as the United States the families granted forever that a certain percent of their gains in the United States would be given to the British Crown (Lords of London) The Huguenots covenant with Queen Anne was that half their gains would be given to the British Crown, and they made this agreement in exchange for her arranging, on board her ships, transportation for them to the United States and also she hid them form Napoleon's armies.

The people of this country have never become independent of England. The wars we fought did not gain us anything and the real truth of why the people went to war has been covered up like all other conspiracies.

They received from the Crown land grants, which were in free and common soccage, (which was only another way of saying lease not ownership), in the British Colonies. You have to remember that the King of England gave nor granted anything to we the people. He demanded to be paid one half of all mineral wealth we extracted from his lands. Every time we thought we gained freedom from England the King came back with a new trick, like the Internal Revenue System and the Social Security which will be explained in detail in Pandora's Box II. Therefore in the copy of the original incorporation papers of the Federal Reserve proves the covenant is still valid with Edmond Dempsey of Boston representing Lords of London receiving 25 shares and George Bashore (which was a Payseur) receiving 25 shares and the balance which was 199950 sold to the public elected by Nathaniel Wilson of Washington, DC to establish a common currency between Europe (England) and the United States, known as the Gold Standard. July 15, 1893.

On the next four pages you will find the original incorporation papers of the beginning corporation that was to somedav be known as the Federal Reserve.

352

-

-

JOHN D. ROCKEFELLER, STANDARD OIL AND

WORLD MONOPOLIES

Everyone has for many years been lead to believe that the Rockefellers were the people that owned and founded the Standard Oil Company and that the Rockefellers were the owners of banks and vast fortunes even from the mid-eighteen hundreds.

The Rockefellers really were part of an elite group of men that became the front men for one family that really owned the wealth of this country. Because of the vastness of this empire the family had to have key people to head up the large corporation. They were put in controlling position of these companies and were made to look like they were the owners when in reality they were only the 'TRUSTEES', of these companies.

John D. Rockefeller, a Trustee for what is now known as Exxon Corporation (formerly Standard Oil of

New Jersey), first became interested in oil in 1863 when he was sent to Pennsylvania by a group of Cleveland. Ohio businessmen to investigate oil operations. At that time he was not impressed with, the producing end of the business, but he did see a future for the refining and marketing side. And on this premise he and his associates developed their holdings until Standard Oil Company was incorporated in 1877.

These people were convinced that small local firms could be bought out because then they could not survive in the highly competitive oil business. Small businesses were bought out and they a l l became part of the huge Standard Oil Trust in 1882. Decisions were made bv an executive committee with Rockefeller as head.

Standard Oil Company was incorporated in New Jersey on August 15, 1882, by the Standard Oil Trust. This oil company really owns all oil companies everywhere and all their subsidiaries. This oil company is owned by a little railroad line in North Carolina and that little railroad line was merged into the 1906 Southern Railway Merger that J. P. Morgan was so famous for. A l l of this was owned by one man by the name of Louis Cass Payseur. The true ownership has been hidden from the public eye because the family did not want to be known and also to avoid anti-trust laws. So it was set up with trustees to operate the company.

The first Standard Oil marketing operation outside the United States was the formation of Anglo-American Oil Company. Ltd. in 1888. Next came the purchase of Deutsch-Amerikanische Petoleum-Gesellschaft in 1890, resident agents were established in the Far East by 1893. By 1895 the company had built up an ocean going fleet of ships (which were the extension of the railroad around the world) to supply this growing foreign trade. Its first tanker was built in 1886.

The increasing need for crude oil forced the company to engage in larger production of crude oil. The company had production operations in Pennsylvania. Ohio and Indiana by 1889. In the late 1890's and early

1900's new oil was discovered to the West, so the company engaged in the search for oil in Illinois. Kansas. Oklahoma. Louisiana. Texas, and California.

These discoveries required that the manpower be increased and new subsidiaries be formed and a new TRUSTEE had to be appointed to head these companies in oil rich western America. Names like Sinclair, Getty, Kerr-McGee, Phillips. Champlin just to name a few. Are you beginning to get the big picture. All this can be backed up with legal courthouse documents.

Accompanying the extension of producing activities was the building of pipelines. The company had gathered lines from its earliest days in the production phase of the oil business, but in 1879 Tidewater Pipe Company proved the feasibility of a cross county pipeline. By 1908 Standard had transcontinental pipelines started in the United States. By 1911 its 10,000 miles of trunk lines extended from Baton Rouge. Louisiana northwest through Oklahoma and Kansas, northeast to Indiana and on the Eastern Seaboard. The company's leading refineries in 1911 were located at Bayonne, Jersey City and Bayway, New Jersey, Baltimore. Maryland and

358

Parkersburg, West Virginia. Now ask yourself one simple little question and it is that, why, way back in the

1870's was there such a need for oil. it wasn't until the 1890's that automobiles started to appear and not until around 1910 did they really start becoming popular. Why the push for oil? The answer is the railroads and shipping fleets that were growing so fast were all owned by this family. It just makes good sense to own the companies that produce the goods that supply another facet of your business empire. A l l part of transportation and communication.

Some of the other names that you can connect to Standard Oil are Esso. The Carter oil Company formed in

1893 to produce oil in West Virginia. International Petroleum Company was established in 1917 to operate newly acquired properties in Peru. Then came Humble Oil refining Company of Texas. Just to make note of some other names it does business as is Amoco, Sunoco, Vaccum Oil etc. and the list goes on and on.

A policy set in the 1920's showed that Standard intended to continue interest in foreign production. It began operation in the Middle East in 1928 and investigated oil prospects in Mexico and Colombia. The country of Colombia was an important oil source for the company by 1926.

The unbalance in transportation facilities was corrected by creating a new United States flag fleet operating directly by the parent company.

West India Oil Refining Company was acquired in 1922.

Creole Petroleum Company were acquired in 1928, and in the same year an interest in Turkish (now Iraq) Petroleum company. To strengthen its refining position Standard bought patent rights outside Germany for a new refining process called hydrogenation. Its foreign marketing strength was increased by 1930 when Standard once again came to power with Anglo-American Oil Company. In 1932 other foreign properties were added by the purchase of Lake Maracaibo, Venezuela, and a refinery at Aruba in the Netherlands West Indies.

Lago Petroleum Corporation and Creole Petroleum Company were merged in 1944. In the same year Standard acquired direct ownership of ocean going tankers. Other marine properties of Standard Oil Company of Louisiana were acquired by Interstate Pipe Line Company .

Standard Oil Company of New Jersey's name was changed in 1948 to Esso Standard Oil Company and under the new name continued to operate all refineries and marketing facilities. Foreign marketing facilities were strengthened in 1948 by the acquisition of Soc. ddu Naphte S. A. (Switzerland) which marketed in various Middle East countries. Foreign production was added by acquisition of a large interest in Arabian American Oil Company in 1948.

November 1, 1972, the company changed its name to Exxon corporation. The name was also adopted by the company's United States subsidiaries.

Divisions and affiliated companies of Exxon Corporation operate in the United States and about 100 other countries. Their principal business is energy, involving exploration for and production of crude oil and natural gas, manufacturing of petroleum products and transportation and sale crude oil, natural gas and petroleum products, exploration for and mining sale of coal. Exxon Chemical Company is a major manufacturer and marketer of petrochemicals. Exxon is also engaged in exploration for and mining of minerals other than coal such as gold, silver etc.

A list of a few of Exxon Subdivisions: Exxon Chemical Company

Exxon Chemicals Americas

Exxon Coal and Minerals Company Exxon Company, U.S.A. Natural Gas Exxon Company, International

Exxon Gas System, Inc.

Exxon Pipeline Company

Exxon Production Research Company

359

Exxon Research and Engineering Company

Exxon Shipping

Esso A. G. of Germany

Esso Austria A. G.

Esso Brasileira De Petroleo of Brazil

Esso Caribbean and Central America

Esso Europe-Africa Services Incorporated

Esso Exploration and Production Australia Incorporated

Esso Australia Limited

Esso Exploration and Production United Kingdom Limited

Esso Italiana

Esso Nederland B. V. Esso Norge of Norway Esso North Europe

Esso Resources Canada and Imperial Oil Limited

Esso Societe Anonyme Francaise of France Esso Sociedad Anonima Petrolera Argentina Esso Standard Oil S. A. of Bahamas

Esso Standard Oil of Uruguay

Esso Switzerland

Esso Tankschiff Reederel GmbH of Germany

Esso Transport Company, Inc. Esso Colombiana Limited

Friendswood Development Company a subsidiary, of Exxon, it has become Houston, Texas biggest, developer of homes and apartments.

Monterey Pipeline Company Petroleum Casualty Company Plantation Pipe Line Company

Arabian American Oil company ( ARAMCO ) and Trans-Arabian Pipe

Line Company Tapline a subsidiary of Aramco

BEB Erdgas und Erdol GmbH of Germany

Interhome Energy, Inc. Home Oil Company Limited

One of the next places these oil hungry people found oil was in Russia's great Baku Field on the Caspian Sea. By 1883, a railroad had been built to the Black Sea. the Czar had invited his distant family, (heirs of the former Louis XVI, that were now in America building a Banking and Railroad Dynasty,) to come help in the growth of Russia.

This is how it all started in Russia with what you today call the Internationalist.

360

-

-

ASSET ACQUISITION

The consolidation and merger of all the smaller railroads into the precursors of the railroad system we know today was chiefly accomplished through the cyclic fluctuation of boom time and depression which occurred, as formerly mentioned, in the 1860's, the 1870's and. most importantly, the depression of the early 1890's.

During the process of those mergers, consolidations, buy-outs and re-leases etc., virtually every railroad operating company fell under the terms of prior leases and mortgages, almost all of which carried exception clauses to the effect that, if the document was a lease, that any assets purchased by the lessee were to become the property of the lessor, or, in the case of mortgages, subject to prior lien-mortgage bonds of another ancestral lessor (be that lessor a company or an individual).

A paragraph in a classic lawsuit of the Circuit Court of South Carolina, namely 150F. 775. Lee vs. Atlantic

Coast Line Railroad Company, dated December 23. 1906, states:

"it should he borne in mind that, while all the stock of the local corporation was surrendered and canceled, nevertheless, about

$1,000,000 worth of the capital stock of the Atlantic coast Line Railroad Company (or the parent company) was not canceled, but is still outstanding, thus clearly indicating that, while it was the purpose of the parties that the local corporation should cease to exist, it was also the intention that the Atlantic Coast Line Railroad Company should be the sole survivor, and as such should own and control all the property, rights and franchises which it had acquired by purchase as herein before stated, and that it was to own and possess all of the property, rights, titles and franchises thus purchased, to the same extend and in the same manner as it owned and possessed the property which it originally acquired by virtue of the charter which brought it into existence."